Hongjiu Viewpoint: From the aspects of regulations, market, application, topic degree, and so on, we selected the 10 most noteworthy raw materials.

The year 2022 is over. During the year, some ingredients were approved as new food ingredients in China, some ingredients began to weaken from their original “hot” status, some became new favorites in the end-product market, and some faced serious challenges……

Looking back to 2022, Hongjiu Biotech selected the 10 most noteworthy raw materials based on regulations, market demand, application trends, topic popularity, and other dimensions, and shared them with all of you.

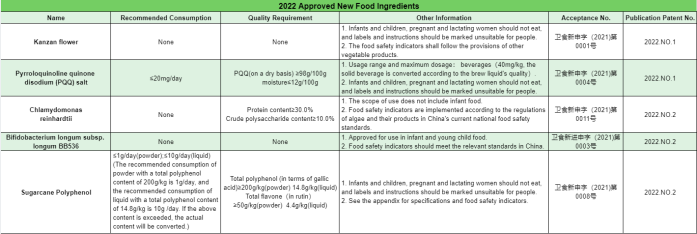

5 New Food Ingredients

When it comes to healthy ingredients, the first thing that must come to mind is the five new food ingredients approved in China in 2022, including Kanzan flower, Pyrroloquinoline quinone disodium-salt(PQQ), Chlamydomonas reinhardtii, BB536 Bifidobacterium longum subsp. longum BB56, and Sugarcane Polyphenol.

Kanzan Flower: Give Food and Drink the Real Impression of Spring

- Flavor selling point: 5

- Functional attribute: 3.5

- Application potential value: 5

Sakura has always been an essential element of spring food and beverage, it represents the appearance level, aesthetic, and spring impression. But, in the past, packaging labeled sakura flavor, sakura flavor or marketed as sakura food and beverage, actually do not contain the real “sakura flavor” the so-called “sakura flavor” is a combination of fragrances and spices to create an “imaginary sakura flavor.”

On March 1, 2022, the National Health Commission of the People’s Republic of China issued an announcement, that officially approved Kanzan flower as a new food raw material. This allows sakura to go to food and beverage, to meet people’s needs.

Use Case: Naturally Cherry Blossom Essenced Sparkling Water

LaCroix, an American sparkling water brand, celebrated Valentine’s Day in February 2022 with its cherry blossom-flavored sparkling water, featuring “sour and sweet botanical flavors and dazzling blooming spring flavors.” It believes that cherry blossoms have always represented fresh, gorgeous, and delicate beauty, and it wants its products to bring the same feeling to users.

In addition to sparkling water, salted cherry blossom and cherry blossom tea are also popular cherry blossom products abroad, which are for reference by domestic enterprises.

Winter is coming to an end, and perhaps we will see more cherry blossom products the next spring.

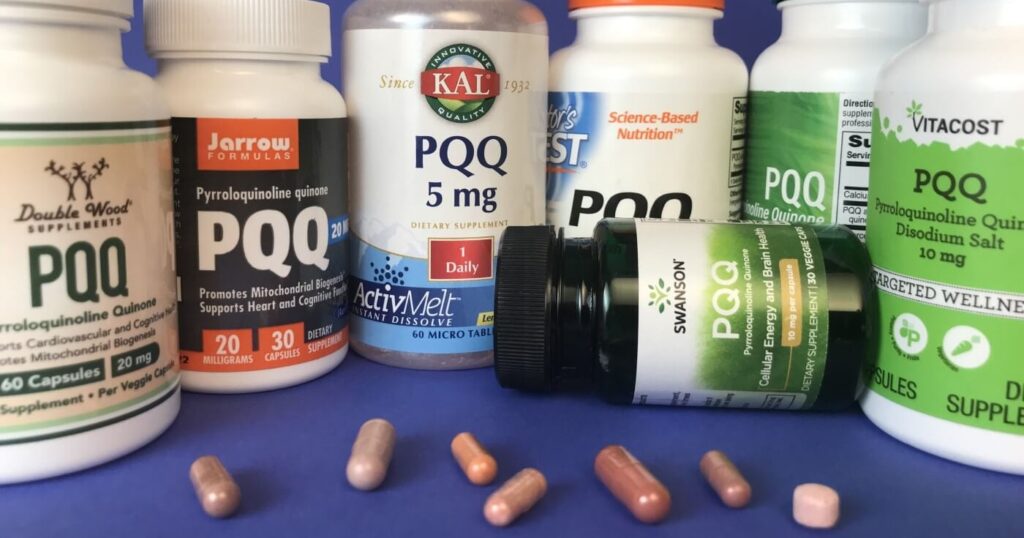

Pyrroloquinoline Quinone Disodium-salt(PQQ):

- Flavor selling point: 4

- Functional attribute: 5

- Application potential value: 5

Like the Kanzan flower, Pyrroloquinoline quinone disodium-salt(PQQ) is also a new food raw material approved on March 1, 2022. The recommended dosage is less than 20 mg/day, the use scope is limited to beverages, and the approved production process is synthesis.

PQQ can support the growth and development of mitochondria, promote cell growth, remove free radicals and reduce cell damage. It is thought to have great potential in cardiovascular health, brain health, and metabolic function health. Therefore, in terms of function, PQQ can be described as “gifted”, but it still lacks detailed scientific basic research, efficacy verification, and so on. At the same time, in terms of consumer cognition, it is also insufficient, requiring long-term market education.

PQQ can support the growth and development of mitochondria, promote cell growth, remove free radicals and reduce cell damage. It is thought to have great potential in cardiovascular health, brain health, and metabolic function health. Therefore, in terms of function, PQQ can be described as “gifted”, but it still lacks detailed scientific basic research, efficacy verification, and so on. At the same time, in terms of consumer cognition, it is also insufficient, requiring long-term market education.

Because of the functional attributes of PQQ, the future application potential is huge.

Chlamydomonas Reinhardtii:

- Flavor selling point: 3.5

- Functional attribute: 4

- Application potential value: 4

Chlamydomonas Reinhardtii was approved as a new food raw material in May 2022. Its main nutrients include protein, carbohydrates, fats, amino acids, vitamins, and minerals, among which protein ≥30.0% and crude polysaccharides≥10.0%. Can be used in pasta, drinks, and dairy products.

The nutritional value of Chlamydomonas Reinhardtii is very rich, which can meet the needs of users for nutritional supplements, meal replacement, intestinal health, and so on.

Bifidobacterium longum subsp. longum BB56:

- Flavor selling point: 4

- Functional attribute: 4

- Application potential value: 3

Bifidobacterium longum BB536 is a probiotic from Morinaga Company in Japan. This strain is isolated from healthy infant intestines. It has been approved for use in infant food in the United States and Japan, and this time it is approved for use in infant food in China. The end products of its related raw materials were sold in China through cross-border e-commerce in 2018.

However, as this raw material belongs to a single company’s patented raw material, from the perspective of the application, compared with other raw materials, the potential is slightly insufficient. At present, it is rare to see related terminal products with this strain added in China.

Sugarcane Polyphenol:

- Flavor selling point: 4.5

- Functional attribute: 5

- Application potential value: 4

Sugarcane polyphenol have a low GI, high antioxidant, anti-inflammatory, and other health properties, and can be widely used in beverages, dairy, bakery, candy, functional food, and other innovative food products.

Compared with other raw materials, sugarcane polyphenol have outstanding functional properties and a wide range of applications. However, compared with white kidney beans for weight management, sodium hyaluronate and collagen peptides for oral beauty, vitamin mineral raw materials, and probiotics/prebiotics for immune health, consumers’ awareness is relatively low. Raw material enterprises and downstream terminal brands need to work together to carry out long-term market education so that the raw material in the terminal market ushered in a period of rapid growth.

Market Focus Material

Erythritol: From Peak to Decline

- Flavor selling point: 4

- Functional attribute: 3

- Application potential value: 3.5

If the previous few years were the era of erythritol, then 2021 will be the peak of erythritol. In 2022, erythritol has gone from hot to no longer hot because of overcapacity and falling prices.

According to the Economic Observer, in 2021, the price of erythritol peaked at 36,000 yuan/ton, and even on December 9, 2021, the market price was 23,000 yuan/ton, an increase of more than 50% compared with the beginning of 2021.

As a result, major manufacturers have announced capacity expansion. According to the statistics, the total capacity of erythritol produced by just six leading producers will reach 445,000 tons/year, which is already 20 times the total consumption of erythritol in China in 2021.

The production capacity is increasing rapidly, but the consumption has not realized the leapfrog growth. Under the background that the supply far exceeds the demand, the price of erythritol has also dropped significantly. According to the insiders, the lowest price of erythritol has dropped to less than 10 yuan /kg.

With the increasing awareness of more sugar substitute raw materials in the consumer market, the substitutability of erythritol is gradually emerging. The lower price will reduce the enthusiasm of enterprises to participate, but also reduce the cost threshold of the downstream application. The more critical question is whether upstream raw material enterprises and downstream end consumption circuits can join hands. To promote erythritol, which has a mature cognition of the raw material into more food and beverage categories, not just stays in the beverage circuit.

Erythritol still has a window of several years before new sugar substitutes arrive, and the winner will be the one that can break out of the application circuit and expand into a wider market.

Mogroside:

- Flavor selling point: 4.5

- Functional attribute: 5

- Application potential value: 5

As a homology substance of medicine and food, Luohan Guo has the function of clearing heat and relieving summer heat, relieving cough, and moistening the lungs. Moreover, it can also be used as a substitute for sucrose, and its sweetness is 300 times that of sucrose. According to SPINS ‘market data, the use of monk fruit extract in foods and beverages labeled clean in the US increased by 15.7 percent in 2020.

After gaining popularity in the international market, Mogroside has become increasingly popular in China in recent years. Not long ago, Nai Xue’s Tea announced the full use of “Mogroside” in its stores, which has made Mogroside once again attract attention from both inside and outside the industry.

Previously, the application of Mogroside was limited to the planting area of Luohan fruit. However, through the breeding technology and planting technology of enterprises in the plant extract industry of China, the planting area limitation of Luohan fruit has been broken through at present, and its production capacity may be further improved, which will also promote its application in the downstream market.

In the next few years, the domestic sugar substitute market may change, and mogroside’s outstanding advantages in functional properties, medicinal and edible homologous substances, etc., will help it become the next strong competitive raw material in the sugar substitute market.

NMN: After Twists and Turns, the Road Ahead is Lost

- Flavor selling point: 5

- Functional attribute: 4

- Application potential value: 3

Looking back at the healthy ingredients of 2022, one of the most tortuous is NMN.

In the first half of 2022, the NMN of three companies was registered and approved by the State Food and Drug Administration as cosmetic raw materials, which made the long-cooling NMN market excited. In August of the same year, the NMN raw material of a domestic company was officially approved by the NDI of the US FDA and could be used for the production, sale, and promotion of dietary supplements in the US, which made the NMN market explode again.

However, as the NMN market was expected to “spring day”, a sudden change changed the trend. In November 2022, in response to the NDI application submitted by Jindavir, a Chinese company, the FDA stated that, due to the drug exclusion rule, NMN is a new drug and shall not be marketed as a dietary supplement or as a dietary supplement. In addition, the NDI certification of NMN raw materials previously approved has been withdrawn.

This reversal of faith has put NMN in a whirlpool, although not on the brink of death, compared to the previous good situation is a rapid change. The United States is one of the major markets for NMN, and the approval of the FDA will also help the promotion of regulations in other parts of the world to some extent. Now, with FDA pressing the “pause button”, it is hard to say how NMN will develop in the future. However, as a raw material highly recognized by domestic consumers, the market of NMN will not drop to anybody. Companies may move from the U.S. to Japan to bring their finished products to the Chinese market through cross-border e-commerce.

Ginseng: The First Year of Ginseng 2022

- Flavor selling point: 4

- Functional attribute: 5

- Application potential value: 5

Looking back at 2022, what is the most talked about ingredient yet? Ginseng is the first answer that comes to mind.

2022 is the year of ginseng. This year we ushered in the product beyond the traditional ginseng water, the main scene of staying up late; Also see ginseng new play, the combination of chocolate and ginseng, in a delicious and convenient form to move the market; Ginseng products in various forms, including ginseng powder, ginseng tea, and ginseng freeze-dried tablets, were also seen.

As a nourishing food material spread for thousands of years, there is no need to mention how high the consumer awareness of ginseng. Under the current high enthusiasm for health and tonic, how to “play” ginseng to a new height is the key for enterprises to seize the opportunity. Whether it is a whole root of intuitive ginseng, or more easily absorbed ginseng powder with high-tech support, freeze-dried ginseng, or snack ginseng chocolate…… The answer has been given.

But this is not the end of ginseng. According to the Feasibility Study Report on China’s Ginseng health Products Market in 2021-2025 released by Xinsi Industry Research Center, the output value of China’s ginseng health food industry in 2020 was 22.217 billion yuan, and it is expected that by 2025, the output value of China’s ginseng health food industry will be 37.169 billion yuan.

We believe that in the next few years, the market will usher in more ginseng products, we look forward to seeing more enterprises play the “sense of technology” play the “sense of value” let ginseng from the “high-end atmosphere and grade” into the daily life of more consumers.

Lutein Ester: the main raw material of eye protection track

- Flavor selling point: 4

- Functional attribute: 4

- Application potential value: 4

In terms of the application market, lutein esters are also expected to increase in 2022 thanks to the popularity of eye protection tracks. According to relevant data, the market scale of eye care in 2019 was 170 billion yuan and maintained a compound annual growth rate of 20%, and in 2021 has exceeded 200 billion yuan. As the main raw material of the eye protection track, lutein ester has become popular in the downstream terminal market.

Favorable policies, coupled with the urgent need for eye care and the continuous launch of products in the market, the whole market space of lutein ester is still to be further developed. And, lutein ester can be used for baked goods, dairy products, drinks, ready-to-eat cereal, frozen drinks, condiments, candy, and other directions, there are many ways to play.

With the improvement of consumers’ awareness of lutein ester, there are more possibilities for future “lutein Ester +” products.

Summary

Based on the overall market, the number of new food raw materials approved in 2022 is not large, among which, Kanzan Flower, PQQ, and Chlamydomonas Reinhardtii have more driving forces to enter the market, and can already see the emergence of terminal products on the market. But as new food raw materials are approved in 2022, they still need more new products and popular products to drive the development and progress of the whole market.

On the market side, it’s been another year of ups and downs. The sharp drop in the price of erythritol, a popular ingredient, has given the industry more to think about how to properly expand production, how to improve the uniqueness of raw materials, and how to expand the application circuit, rather than just following the seemingly hot trend. The twists and turns of NMN also let the industry see the impermanence of the world, but also remind enterprises to improve their ability to resist risks.

In any case, the uncertain, special and difficult 2022 is behind us. Companies in trouble need to find their way out; Companies with a keen sense of smell have found their way; And smart companies have already found opportunities in adversity.